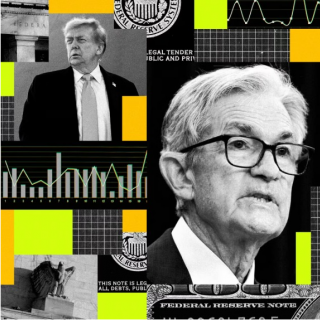

Markets are kicking around the idea of a Federal Reserve rate cut in September, but Morgan Stanley isn't sure, warning that the odds may be closer to 50-50 despite widespread expectations. Strong economic indicators including solid GDP growth, healthy financial conditions, and low volatility stand in the way of a clear case for easing, the bank said in a recent report.

Nominal GDP growth remains robust at over 5%, unemployment holds steady at 4.2%, and retail sales continue surpassing expectations, reflecting an economy far from needing stimulus, Morgan Stanley's economists said. "It cannot be because of a weakening economy," they added.

The broader financial environment, meanwhile, backs this resilient picture, with credit spreads at their tightest in 18 years, corporate bond issuance near record highs, and bank credit availability at a two-year high. Markets themselves are stable, hitting record highs amid low volatility and regulatory relief that promises to ease liquidity constraints further.

Inflation, however, remains stubbornly above the Fed's 2% target, adding complexity to the decision. Core consumer prices climbed 3.1% year-on-year in July, with producers' prices up 3.7%, and consumer inflation expectations jumping to 4.9%. Morgan Stanley emphasized that this persistent inflation counters the usual arguments for rate cuts.

A common narrative suggests easing could revive the struggling housing market - held back by high 30-year mortgage rates - but Morgan Stanley warns the Fed's influence on longer-term mortgage rates is limited. Longer-duration Treasury yields been pushed higher by investor concerns about growing federal deficits and increased debt issuance.

While Powell signaled that a rate cut could be coming, there upcoming employment and inflation reports in September, is likely to offer investors more clarity on whether rate cuts make sense, Morgan Stanley said.

As debate continues on whether a rate cut at the next's month Fed meeting is on the cards, the bank believes now is the time add real assets and dtich small-cap, unprofitable tech as well as low-quality meme stocks.

Morgan Stanley recommends adding exposure to real assets like gold, real estate investment trusts, and energy infrastructure to "complement portfolios that are benchmark-weighted in passive U.S. equities."

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Gold price rises on Friday, poised to end with weekly gains of nearly 4% as an employment report in the US was mixed, with the economy adding fewer jobs than projected. Still, the Unemployment Rate ticked lower, yet investors are still betting the...

Harga emas kembali menguat pada perdagangan terbaru setelah sempat tertekan, didorong oleh melemahnya dolar AS dan turunnya imbal hasil obligasi pemerintah AS. Investor kembali memburu emas sebagai aset lindung nilai di tengah ketidakpastian arah...

Silver is currently hovering around $77,430, likely awaiting triggers from the US dollar and yields. If the dollar strengthens, silver is usually resilient; if the dollar weakens, silver rises more easily.Fundamentals are still supported by safe...